by JOHN BANCROFT

As anticipated the Bank of Canada kept the overnight rate at 1% where it has been since September 2012. The longest period of time since the 1950’s. The statement indicated that “considerable monetary policy stimulus currently in place will likely remain appropriate for a period of time, after which some modest withdrawal will likely be required.” Justification for keeping rates the same were a continued slack economy, slower Canadian household debt build up, and a muted outlook for inflation. The statement also noted that Canadian exports will continue to struggle due to competitive challenges with the strength of the Canadian dollar and tempered foreign demand, but that exports are expected to recover over time. The next scheduled date for announcing the overnight rate target is July 17, 2013. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be released at the same time.

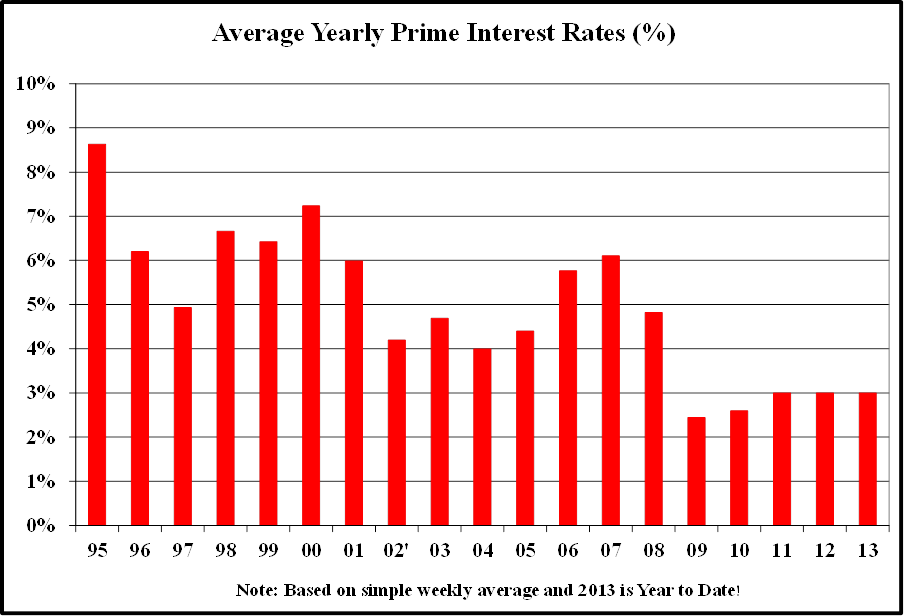

The graph below shows the yearly trend of the prime interest rates impacting Canadian consumers and businesses.

Disclaimer: This commentary is provided for information only and is not intended as advice