For most of 2015, the grain futures markets have been largely focused on the abundance of supply of corn, wheat, and soybeans worldwide and speculating on whether prices are low enough to stimulate enough demand to burn through record-large stocks. Supply and demand estimates have consistently reported stocks numbers which would suggest that this school of thought is fundamentally correct. Grain inventories globally are large enough that prices need to be low enough to encourage its use and certainly not high enough to ration demand. So what has happened in the futures markets in the past week to cause prices to rally to recent highs, and how long can we expect this trend to last?

Our recent run up in Chicago Mercantile Exchange futures values is really the result of a perfect storm of factors all coming together at once. The first of these is that the market is starting to wrestle with the first potential adjustment to grain stocks. Although it has taken until late June, for the first time in the 2015 crop production year, weather has really started to impact the commodity market. A mid-June USDA release indicating that 14 per cent of the American soybean crop had not yet been planted along with continued stories of poor quality winter wheat as the combines move north from Texas harvesting the 2015 crop, and consistent, persistent rain which has accumulated to levels which are not useful for crop developments in much of the central and eastern U.S. corn belt. For the first time since the futures market started contemplating 2015 planting intentions, there is now a strong sense that all might not be going perfectly with North America’s 2015 crops.

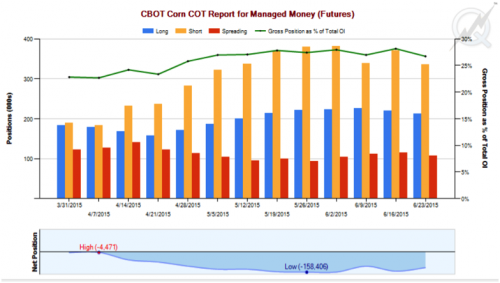

If you are an observer of the grain futures and derivatives market, there are two indicators which indicated that the managed money was not expecting problems with crop production this summer. The first of those is that options, (puts and calls), have been unusually cheap this spring and summer. That indicates that at least the parties “writing” or selling the options were not expecting much price volatility or they would never sell such a product at a low value. The second indicator of the managed money’s perspective on the market is that they have accumulated massive short positions, selling off ag commodity futures contracts in the anticipation that they will be able to buy those positions back in later at lower prices and harvest a return from their position.

The chart below is from the Chicago Mercantile Exchange website, and very effectively displays the distribution of the “managed money’s” distribution in corn futures. It’s critical to remember that the futures market is always in balance. If the speculators have sold corn futures, then the commercial have bought those futures contracts.

The psychology that is driving the rally in grain prices right now is that with increasing serious weather problems developing, and a significant USDA Quarterly Stocks Report coming out at the end of June which might alter the supply and demand picture, the short positions need to buy their way out of their positions before they find themselves on the wrong side of the trend. This is the nature of our late June grain futures price rally. A little bit of a weather problem, a substantial government report which might confirm the production problem, and a short position that is less comfortable than it was a month ago.

The potential for the futures rally to continue largely depends on two factors. The first is whether the USDA makes any substantial adjustments to their supply and demand estimates in the June Quarterly Report, and the second is whether the sun comes out and we return to a more normal weather pattern for the balance of the 2015 growing season. Essentially grain producers get to bet on the government and the weather –– two of the least predictable things in the world.

For producers, the extremely useful thing which has come out of the late June rally is that we have an opportunity to catch up on some sales, or tidy up the loose ends in our 2014 crop marketing plan. Rewarding a rally with a few incremental sales is a good strategy, and these are the best prices that the Ontario farmer has seen in the calendar year. The size of sales that you chose to make is entirely based on your expectation of how long the weather problems can persist.